The 10-year Treasury briefly dipped below 3% this morning. Is this a reflection of fear, deflation, or a result of all the money being poured into the system over the past few months?

Wednesday, November 26, 2008

10-year Treasury at 2.995%

Posted by

Joshua Ulrich

at

9:50 AM

0

comments

![]()

Labels: Credit, Federal Reserve, Markets

Thursday, November 13, 2008

Stock Surge Off New Lows

Both the S&P500 and the Nasdaq Composite registered fresh 52-week lows around 1:00EST during today's session. Soon after, they both began rallies and would close a massive 10% higher than their intra-day lows. Volume surged on both the NYSE and the Nasadaq (see charts below - or links in the blog's right-hand column) as the rally progressed.

The charts above show that volume picked up during the rally and was much higher than the past several days on both exchanges. (The bottom portion of the chart shows today's volume relative to yesterday.)

Further, breadth was impressive: advancing issues outnumbered decliners on both the NYSE (2,650/919) and NASDAQ (2,089/799). Up volume accounted for 77% of the NYSE volume, while 89% of the Nasdaq volume was positive.

Could this rally mark the end of this devastating - in both speed and magnitude - bear market? Stay tuned...

Posted by

Joshua Ulrich

at

9:17 PM

2

comments

![]()

Labels: Markets

Wednesday, October 29, 2008

Fed Holds Rates Steady

The opening sentence of today's FOMC statement reads:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 1 percent.Decided today, really? By looking at the effective federal funds rate, it looks like this policy action was decided two weeks ago.

Posted by

Joshua Ulrich

at

9:00 PM

0

comments

![]()

Labels: Federal Reserve

Thursday, October 23, 2008

Last-Minute Rally

With one and a half hours left in today's session, the S&P 500 rose from its intraday low of 860 to 908 at the close. That's a 5.6% intraday move to close the session up 1.26%. That's quite an impressive rally, but how was volume and breadth?

The chart above shows NYSE volume was much heavier today than the past couple days. The bottom portion of the chart shows today's volume relative to yesterday.

Cumulative volume compared to yesterday increased steadily all day, as stocks fell, until the last couple hours of trading. This suggests buying was sparse even though the price movement was strong.

Further, breadth was not at all impressive: declining issues outnumbered advances on both the NYSE (2,152/1,291) and NASDAQ (2,032/824).

Posted by

Joshua Ulrich

at

6:54 PM

0

comments

![]()

Labels: Markets

New Blog - FOSS Trading

I've started a new blog to focus on trading and quantitative finance using free open source software. I will post updates on my R packages on that blog instead of Quantitative Contemplations.

You can find the new blog at http://blog.fosstrading.com.

Posted by

Joshua Ulrich

at

9:50 AM

0

comments

![]()

Labels: Finance, Markets, Programming

Wednesday, October 22, 2008

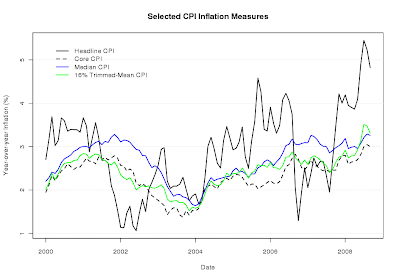

September Inflation

The chart below shows headline and core CPI have climbed sharply since mid-2006. Headline CPI is currently near 5% year-over-year, while all measures of core CPI are at 3%.

The following chart shows inflation expectations via the spread between the 10-year constant maturity Treasury rate and the corresponding TIPS rate. Expectations currently stand at an average of 1% per year for the next 10 years. I seriously doubt this will be realized; it's more likely a function of the current market pessimism.

Two important caveats: (1) the spread has two components - expected inflation and inflation risk premium, and (2) TIPS yields have a liquidity premium. Given the short-term nature of our comparison, neither of these caveats should be too problematic.

Posted by

Joshua Ulrich

at

10:36 PM

0

comments

![]()

Labels: Federal Reserve, Inflation

Thursday, October 9, 2008

Short Sale Ban Lifted

Today was the first day since September 19 that many financial stocks could be sold short. And there was certainly a lot of selling today. The Financial Select Sector ETF (XLF) dropped 10.4%.

If you only consider today's action, you may conclude that the short-selling ban was working. That could not be further from the truth. Financials rose nearly 12% on the day the ban was instituted, but it was almost all downhill after that. Only 4 of the next 13 days were positive. Over the whole period the ban was in effect, the XLF fell 23.6% (from the close on 9/18 to the close on 10/8).

The major indices have seen declines, many of them severe, in the last 7 consecutive trading sessions. We most certainly would have seen a short-squeeze within that period, had short sales been allowed.

Posted by

Joshua Ulrich

at

7:28 PM

0

comments

![]()

Wednesday, October 8, 2008

Surprise Fed Cut

From this morning's press release:

The futures market initially shot up in response to this news. Within an hour, however, they had fallen back to their pre-release levels. Perhaps the market realized this crisis has not been due to restrictive monetary policy, but rather deleveraging of financial institutions and ignorance of where those institutions' risk lies.Inflationary pressures have started to moderate in a number of countries, partly reflecting a marked decline in energy and other commodity prices. Inflation expectations are diminishing and remain anchored to price stability. The recent intensification of the financial crisis has augmented the downside risks to growth and thus has diminished further the upside risks to price stability.

Some easing of global monetary conditions is therefore warranted. Accordingly, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, Sveriges Riksbank, and the Swiss National Bank are today announcing reductions in policy interest rates. The Bank of Japan expresses its strong support of these policy actions.

Federal Reserve Actions

The Federal Open Market Committee has decided to lower its target for the federal funds rate 50 basis points to 1-1/2 percent. The Committee took this action in light of evidence pointing to a weakening of economic activity and a reduction in inflationary pressures.

The spot markets gapped slightly lower but have been making gains since the open.

Posted by

Joshua Ulrich

at

8:27 AM

0

comments

![]()

Labels: Federal Reserve, Markets

Tuesday, October 7, 2008

opentick now on CRAN

The pre-alpha version of the opentick package I mentioned previously is now on CRAN. The package provides a native R interface to the opentick data servers, which include both real time and historical market data.

(Disclaimer: This software is not endorsed in any way by opentick corporation. The author(s) of this software are not affiliated with opentick corporation.)

The package currently includes a limited R implementation of the otFeed API. Its current functionality enables access to historic data from the opentick servers. Future additions will include access to:

- real-time data feeds (for most U.S. stock, option, and futures exchanges).

- real-time option chains.

- real-time and historical book data.

Please note that opentick is not currently accepting new users, but current users will retain their access. This has been the case since April and it is not clear when new users will be allowed. You can sign up to be notified once new users will be accepted.

Posted by

Joshua Ulrich

at

6:56 PM

0

comments

![]()

Labels: Programming

Sunday, September 28, 2008

Saturday, September 20, 2008

Botched Bailouts

I've been following the government's many recent financial bailouts (Fannie and Freddie, AIG) and interventions (Term Lending and Auction Facilities, short selling rules, RTCII) fairly closely.

There has been much discussion of how deregulation of the financial industry lead to this crisis - especially in the case of the (former) five firms that 'enjoyed' net capital exemptions from the SEC - and how the government's recent actions smack of socialist policies.

Until Friday, I had not read anything about how these actions may have exacerbated the financial crisis. Jim Jubak does a superb job of outlining how these rescues have actually made some things worse. The whole article is worth reading, but the highlights are below.

[I]n the name of creating an orderly liquidation of a company such as Lehman Bros., they create a mad scramble to get paid before the bankruptcy court can act.Source:

By wiping out the Fannie Mae and Freddie Mac preferred stock, the Fed and Treasury killed off any possibility that some other financial institution in need of capital could raise cash by selling these dividend-paying shares.

[T]he Treasury and Fed have ensured that no conservative, income-seeking investor in his or her right mind would buy preferred stock from a troubled financial company looking for capital.

After drawing a line in the sand and saying no more bailouts, the Fed and Treasury ponied up $85 billion in taxpayer cash to go into the insurance business. Their excuse for the about-face: Though the Fed had planned for a Lehman bankruptcy, it hadn't modeled a failure at AIG and couldn't predict the consequences of letting the company go into bankruptcy. That's not reassuring.

Botched rescues are killing markets

Jubak's Journal 9/19/2008 12:01 AM ET

Posted by

Joshua Ulrich

at

9:41 PM

0

comments

![]()

Labels: Credit, Economy, Federal Reserve, Finance, Markets

Monday, September 8, 2008

No Longer Seeking Alpha

I will stop frequenting and reading Seeking Alpha because of this:

UPDATE: It appears Seeking Alpha and Barry Ritholtz reached an agreement, as Seeking Alpha has renamed "The Big Picture" as "The Macro View".

Posted by

Joshua Ulrich

at

10:29 PM

2

comments

![]()

Tuesday, September 2, 2008

Lehman Finds Suitor

Breaking News: Lehman To Be Acquired by Tooth FairyThe market responded with enthusiasm to reports that the Tooth Fairy has agreed to acquire Lehman. The purchase price has not yet been determined and will be set by Dick Fuld wishing upon a star, clicking his heels three times, and being transported back to that magical place where Lehman still sells for over $70 per share.

In related news, Lehman has agreed to sell all of its level III capital, including CDOs, ABSs, pet rocks, baseball cards, slightly used condoms, and credit default swaps written by MBIA and Ambac. Lehman’s level III capital will be acquired for 150% of its face value by Tinkerbell, who will carry it off to Neverland to be fed to a crocodile. Lehman is financing 90% of the acquisition at an interest rate that has not been announced; Tinkerbell’s up-front payment consists of a handful of pixie dust, three crickets, and a bullfrog. Analyst Dick Bove estimates that the bullfrog could eventually be transformed into three princes and a pumpkin coach. The deal gives Lehman no recourse to any of Tinkerbell’s assets other than the Level III capital. If Tinkerbell defaults, Lehman’s successor entity will stick its hand down the crocodile’s throat and attempt to get it to regurgitate. The firm’s historical value-at-risk analysis shows that sticking your hand down a crocodile’s throat is completely safe.

Treasury Secretary Hank Paulson issued a statement: “I am delighted that SWFs (Sovereign Wealth Fairies) continue to express confidence in the terrific values represented by American financial institutions. As I have been saying since August of 2007, this shows that the crisis is now over.”

Meanwhile, the SEC has announced an investigation of mean, evil, bad short-seller David Einhorn. While out for a beer with a friend, Einhorn reportedly suggested that the Tooth Fairy does not exist and that wishing upon a star is not a wholly reliable price discovery mechanism. Christopher Cox, chairman of the SEC, said, “Vicious rumors attacking the Tooth Fairy will not be tolerated. Our entire financial system and indeed the American way of life depend on the Tooth Fairy and wishing upon a star. How else could one value level III capital appropriately?” The SEC is reportedly planning to set up re-education camps for short-sellers.

Source:

Lehman, the Tooth Fairy and the Revenge of the Short-Sellers

Posted by Heidi N. Moore

Deal Journal, August 25, 2008, 10:56 am

Posted by

Joshua Ulrich

at

9:22 AM

0

comments

![]()

Labels: Silliness

Wednesday, July 30, 2008

New R-Finance Group on LinkedIn

I've created a new group on the professional networking site, LinkedIn. It is oriented toward finance useRs. The goal of this group is to help members:

- Reach other finance useRs (you decide if group members can contact you directly)

- Accelerate careers/business through referrals from R-Finance group members

- Know more than a name; view other members' rich, professional profiles

Posted by

Joshua Ulrich

at

10:08 AM

0

comments

![]()

Labels: Finance, Networking, Programming

Wednesday, July 23, 2008

70 61 63 6b

I posted earlier about creating the new opentick package. Since it requires reading/writing binary data to a socket connection, I wrote some utility functions to made the conversion to/from raw data easier.

These functions are tangential to opentick and potentially useful to others, so I created yet another package... called pack. pack attempts to replicate the functionality of PERL's pack and unpack functions.

The functions are probably best illustrated via an example:

> computer <- pack('C A3 v x V a*', 3, 'foo', 21, 50000, 'bar')(For those curious, the post title is pack in hexadecimal... sorry, but I find it amusing.)

> computer

[1] 03 66 6f 6f 15 00 00 50 c3 00 00 62 61 72

> human <- unpack('C/A v x V A3', computer)

> human

[[1]]

[1] "foo"

[[2]]

[1] 21

[[3]]

[1] 50000

[[4]]

[1] "bar"

>

Posted by

Joshua Ulrich

at

7:58 AM

0

comments

![]()

Labels: Programming

Saturday, July 12, 2008

Make the Right Choice

Lifehack.org has a nice post about how to make quality choices. One way to analyze choices is to ask yourself why, 5 times. I have to share this hilarious excerpt below:

Ask why – five times

The Five Whys are a problem-solving technique invented by Sakichi Toyoda, the founder of Toyota. When something goes wrong, you ask “why?” five times. By asking why something failed, over and over, you eventually get to the root cause.

Why did my car break down? A spark plug failed. Why? It was fouled. Why? I didn’t get a tune-up. Why? I was too busy playing GTA4. Why? Because I’m miserable and lonely and the people in the game are the only ones that really love me.

See? Your car broke down because you’re a sociopath.

Posted by

Joshua Ulrich

at

11:37 AM

0

comments

![]()

Labels: Silliness

Tuesday, July 8, 2008

The Past Month

I haven't posted much the past month because I have be remodeling my kitchen. We installed a ceramic tile floor, all new cabinets, new counter top, all new appliances. It's been an adventure, since I've never done any of it before.

I've been working on updates to TTR and making small progress on the opentick package, but blog posts have taken a back seat. I will have much more time to program and post when the kitchen is finished in ~2 weeks.

Posted by

Joshua Ulrich

at

10:26 PM

0

comments

![]()

Tuesday, June 10, 2008

The Cause of the Liquidity Crisis

Classic!

Source:

www.dilbert.com

Posted by

Joshua Ulrich

at

2:45 PM

0

comments

![]()

Monday, June 2, 2008

Free Real-Time NASDAQ Quotes

I used to watch the financial markets throughout the day via CNN Money, until most pages force-fed me streaming video that I have to pause/stop manually. That caused me to switch to Yahoo! Finance.

Google Finance will be my new home since they have begun to provide real-time stock quotes for NASDAQ securities. I have become quite the fan of Google products, not because I'm a fan of Google, but because they just make quality products: GMail, Google Reader, Google Calender, Google Maps, Google Code, Google Code Search, and - of course - Google Search.

I haven't tried it myself, but I've heard that Google's SketchUp is quite handy.

Posted by

Joshua Ulrich

at

9:09 PM

0

comments

![]()

Labels: Markets

New Project

I've started creating a R API to the opentick data servers. My goal is to provide a native R interface to opentick real time and historical market data. I have reservations about being able to make it solely R-based, due to threading issues I don't totally understand at the moment.

Even though I've read of quality issues with opentick's data, the price can't be beat for small, part-time traders (i.e. me).

Due to the upgrading of its network infrastructure, opentick is not currently accepting new users. That should change in the near future, however. You can sign up to be notified when the upgrades are complete.

For those who already have accounts with opentick, you can find the very-alpha source code on r-forge.

Disclaimer: This software is not endorsed in any way by opentick corporation and I am not affiliated with opentick corporation.

Posted by

Joshua Ulrich

at

1:50 PM

4

comments

![]()

Labels: Investing, Markets, Programming

Sunday, May 18, 2008

Understated Inflation?

John Mauldin makes an excellent point regarding inflation perceptions in this week's Thoughts from the Frontline weekly e-letter. In short, consumers pay more attention to the items they buy more frequently and, currently, those are the items that are increasing in price the most.

[H]igh-frequency spending items like gasoline, food, education, and medical care make up 50% of the Consumer Price Index. These are items which we buy on a regular basis. And they are going up at a weighted average rate of 6.8%, a lot higher than the 4% for the CPI as a whole.

The 20% of the CPI which are low-frequency items like furniture, appliances, vehicles, and so on are actually falling at a -0.7% rate. Since OER (equivalent rent) is roughly 30% of CPI and is rising at 2.8%, even as home prices fall the overall rate is about 4%.

Our tendency to notice the price increases in more frequently purchased items more than the drop in less frequent expenditures is known as salience. What we see every day is more visible to us and is on our minds. And because the reality is that those prices are rising much faster than headline inflation, we tend to think inflation is understated.

Posted by

Joshua Ulrich

at

7:21 PM

2

comments

![]()

Labels: Inflation, Statistics

Wednesday, April 16, 2008

More Upside to Come?

Quantifiable Edges has an interesting post regarding large gaps up in downtrends. Rob writes,

Buying gaps up of 0.75% or more during downtrends was actually profitable. In this case, 58% of the 105 instances finished with the SPY closing higher than it opened. The net total of the movement from open to close was a gain of about 26%...The Nasdaq gapped up more than 1% today. If there is indeed more upside to come, I would be surprised if the Nasdaq Composite can sustain prices above the top of the 3-month trading range around 2,400.

I suspect short-covering is a big reason that large gaps tend to spark additional buying in downtrends but not in uptrends. Stops get blown through overnight and when they see the market getting away from them, panic-covering ensues.

Posted by

Joshua Ulrich

at

10:51 PM

0

comments

![]()

Saturday, March 29, 2008

Last Bank Standing

My wife has started a home-based business and we've been looking for the best bank to open a business checking account. Today I ask a friend if he knows which institution would provide the best service and he replies,

"If you wait a bit you'll probably only have one left to choose from :)"That had me laughing to myself for a good 5 minutes... and I'm sure I will continue to chuckle about it the rest of the day. I hope you get half the entertainment out of it that I did.

Posted by

Joshua Ulrich

at

6:47 PM

1 comments

![]()

Tuesday, March 18, 2008

Moral Hazard, the Federal Reserve, and Solvency

Yesterday's Outside The Box by John Mauldin provides an overview of the NY Fed's actions around Bear Sterns, along with commentary on the current "credit" crisis.

This is not a bailout. The shareholders at Bear have been essentially wiped out. Note that a third of the shares of Bear were owned by Bear employees. Many of them have seen a lifetime of work and savings wiped out, and their jobs may be at risk, even if they had no connection with the actual events which caused the crisis at Bear. Don't tell them there was no moral hazard.

...

The Fed is taking $30 billion dollars in a variety of assets. They may ultimately take a loss of a few billion dollars over time, although they may actually make a profit. When you look at the assets, much of it is in paper that will likely get close to par over time, and the good paper will pay premiums mitigating the potential loss. The problem is, as the essays below point out, no one is prepared to take that risk today.

- John Mauldin, Editor: Outside the Box

John correctly points out that the NY Fed's actions will not create a moral hazard problem. Bear shareholders lost 90% of their equity from Friday's close, after Bear closed down ~50% from Thursday.

He also notes taxpayers won't likely be stuck with a huge bill. The Fed is doing exactly what its supposed to - act as a lender of last resort. Perhaps they're following the cliche, "buy when there's blood in the streets." I think that characterizes the current state of the credit markets pretty well.

What may be lost in the excitement of the moment, as markets attempt to digest these latest actions, is that were taken by the Board of Governors through the Federal Reserve Bank of NY to address issues of financial stability. These were NOT actions taken by the Federal Open Market Committee (FOMC). Their main responsibility is the conduct of monetary policy for the country.

...

It is time to step back and recognize that the current situation isn't a liquidity issue and hasn't been for some time now. Rather there is uncertainty about the underlying quality of assets which is a solvency issue driven by a breakdown in highly leveraged positions. Many of the special purpose entities and vehicles are comprised of pyramids of paper assets supported by leverage whose values are now unknown.

- Bob Eisenbeis, Cumberland Advisors

These two paragraphs by Mr. Eisenbeis make an essential point that some continue to miss: this is not a liquidity issue. As he notes, these actions were not taken by the FOMC to address a monetary policy issue.

Posted by

Joshua Ulrich

at

12:01 PM

0

comments

![]()

Tuesday, March 4, 2008

January Inflation Reports

The inflation numbers for another month are in, and the results do not look very good. The charts and brief commentary below summarize the changes.

Today Calculated Risk noted that, "inflation expectation have surged recently." They cite a Bloomberg article that charts the spread between the 5-year TIPS and the 5-year Treasury. You can find an interactive chart of the spread between those two rates on the Cleveland Fed's website.

At this point, I think it's safe to say that - contrary to what the FOMC has to say - both inflation and inflation expectations are not well contained.

Annual core PPI inflation has moved from its 2006 lows near 1% to hovering above 2% in the second half of 2007.

Core PCE inflation has jumped back above 2% and trimmed-mean PCE inflation is nearing 2.5%.

CPI inflation is worst of all; core is near 2.75%, 16% trimmed-mean is approaching 3%, and the median CPI is closing on 3.25%.

Posted by

Joshua Ulrich

at

8:45 PM

1 comments

![]()

Labels: Economy, Federal Reserve, Inflation

Monday, February 11, 2008

Countrywide Insurance

Countrywide services my mortgage. Don't worry, I'm not going to default or walk away from my mortgage...

The newest solicitation I've received from them is an application to insure my 'major home appliances or systems'. This seems like a desperate grab for high-margin cash. However, does Countrywide really want people to potentially have to choose between paying their mortgage and paying their appliance insurance premiums?

For only $37.95 per month, conveniently collected with your mortgage payment, you can have the security of knowing that your broken appliance will be replaced.* Imagine... a whole new furnace costing no more than your $60 deductible.*Here are my favorite examples of items for which the policy includes repairs and replacement:

- Garbage Disposal (This is so essential!!!)

- Ceiling Fan (These are $100, maybe $200?)

- Electrical / Heating / Plumbing Systems (All of it?!?!?)

- Thought his furnace would last another year. GAMBLED AND LOST $4,208

- Thought he had the perfect oven. GAMBLED AND LOST $1,486

- Thought their freezer would star frosty. GAMBLED AND LOST $1,023

* This represents the best case scenario. You will probably get hosed for much more.

Posted by

Joshua Ulrich

at

8:49 PM

1 comments

![]()

Friday, January 25, 2008

Wikipedia Errors

Wikipedia has been said to have fewer errors than Encyclopedia Britannica but, as one of my co-workers said, "I bet Encyclopedia Britannica doesn't have errors like this!"

I stumbled on this as I was surfing the web this morning. I was searching for ideas of potential names for a new R bundle I'm working on. It literally made me laugh out loud.

UPDATE: I think my previous image was deleted because of the 'content'. Here's the image, censored. And yes, it's a four letter word; but you can say it on television... I guess just not in front of those two words (I'm not sure what the phrase means).

Posted by

Joshua Ulrich

at

7:11 PM

3

comments

![]()

Labels: Silliness

Thursday, January 24, 2008

TTR version 0.14-0 on CRAN

The coolest change is the Fortran implementations of the running/rolling analysis and moving average functions. They are blistering fast: a 20-period SMA on 1 million observations takes about 30 seconds on my 2.8Ghz processor. I don't know if that calculation would even finish when written only in R code.

You can find the source/binaries here, or on your preferred CRAN mirror. Be sure to check out the charting capabilities in quantmod!

Here are the highlights of the new features:

- Added Fortran implementations of all moving average functions

- Added Fortran implementations of all running/rolling analysis functions, which include runSum, wilderSum, runMin, runMax, runMean, runCov, runCor, runVar, runSD, runMedian, and runMAD

- Added of Stochastic Momentum Index and Williams' Accumulation/Distribution functions

- Changed MA-type arguments for: RSI, ADX, ATR, CCI, DPO, EMV, RSI, BBands, chaikinVolatility, stoch, SMI, TRIX, MACD, and KST. This allows cleaner syntax when specifying moving averages.

Posted by

Joshua Ulrich

at

12:18 PM

0

comments

![]()

Labels: Programming

Wednesday, January 23, 2008

Surprise!

The Fed's inter-meeting 75 bps cut yesterday came as a complete surprise (at least to me). I've previously noted that Fed Funds expectations were for a 50-75 bps cut at the next meeting on January, 29-30.

The statement cited a weakening economic outlook, increasing downside risks to growth, continued deterioration in broader financial markets, tightening credit for some businesses and households, and a deepening housing correction as the reasons for the target rate change.

That said, what's the point of cutting rates inter-meeting a week early? One week will hardly make a difference, given the lag of monetary policy. My only hypothesis is that the FOMC had already been discussing the action - which was mostly based on economic conditions - and they released the statement early, in response to overseas and overnight US futures trading. However, that begs the question of why the FOMC was swayed by equity market conditions.

In addition, and possibly more interestingly, Fed Fund futures still assign a 40% probability of the FOMC cutting another 25 bps next week...

Posted by

Joshua Ulrich

at

8:27 AM

0

comments

![]()

Labels: Economy, Federal Reserve

Tuesday, January 22, 2008

Do the opposite

That's probably the best advice I can give, since US stock futures are currently off about 5% from Friday's close.

Slowly increase over the next week or two... fall off a cliff the very next trading session; same things, right? At least I didn't open any positions based on my "thoughts"...

Posted by

Joshua Ulrich

at

7:23 AM

0

comments

![]()

Labels: Forecasting, Markets

Sunday, January 20, 2008

Monetary and Fiscal Stimulus

There was plenty of talk about fiscal stimulus packages last week. The White House wants tax cuts to help a wide range of individuals and businesses. Privately, it has floated a plan that focuses on rebates of up to $800 for individuals and $1,600 for married couples.

In addition to tax cuts, congressional Democrats say they also want spending targeted at specific groups such as the unemployed. They have also discussed denying rebates to taxpayers who earn more than $85,000 and offering them to those who don't pay income taxes at all.

Despite the market's disappointment, the plan President Bush announced Friday, which is equivalent to about 1% of gross domestic product, came in at the high end of expectations in Washington.

In addition, Fed Funds futures and options show a 40% probability of 50 and 75 bps cuts, and almost a 20% probability of a 1% cut. The jump in the odds of a 75 bps cut was near Bernanke's speech on 1/11 and the wholesale trade and retail sales reports. The probability of a 1% cut increased near the consumer sentiment report and Bernanke's Congressional Testimony.

None of this will ward off a recession in the United States. The slowdown in growth isn't purely a liquidity problem. It's a confidence problem causing a lack of liquidity. Banks won't start lending to one another again until they have a better idea of who owes what. Until then they're going to continue to horde cash to shore up their balance sheets to prepare for the worst.

Further, this isn't just a subprime or even a mortgage problem (we have yet to even reach the pinnacle of the option ARM wave). Issues are beginning to surface in the commercial real estate, auto loan, and credit card secondary markets. Who knows what other credit products will follow?

The actions of the Fed and Washington won't stop the stock market's decline, or the oncoming/current recession, since this current slowdown is a confidence problem, not a liquidity/stimulus problem. And, unfortunately, the problem is likely to get worse before it gets better.

I expect the market to slowly work its way up - with a few relief/short-squeeze rallies - over the next week or two, sending major indices near their August lows (about a 5-6% gain from Friday's close). I will enter a short position in the NASDAQ 100 and/or Russell 2000 near the August lows if they are attained before the Fed meeting next week, since I expect the catalyst to the next major move down to be the outcome of the meeting.

Posted by

Joshua Ulrich

at

7:14 PM

0

comments

![]()

Labels: Credit, Economy, Federal Reserve, Markets

Sunday, January 13, 2008

Predicting Recessions

John Mauldin's Outside the Box newsletter released last Monday discussed many of the current issues facing the stock market. One paragraph in particular stood out to me, since I had read a portion of it elsewhere.

Last week's poor ISM and employment reports add further confirmation to this expectation, particularly given that total non-farm employment has grown by less than 1% over the past year, less than 0.5% over the past 6 months, and the unemployment rate has spiked 0.6% from its 12-month low (all of which have historically indicated oncoming recessions). The ECRI Weekly Leading Index is now clearly contracting as well. The expectation of oncoming recession may be gaining some amount of sponsorship, but it is still far from the consensus view, and is therefore most probably far from being fully discounted in stock prices.I had read before that a reliable indicator of oncoming recession is when the unemployment rate rises 0.5% from its recent trough. I had not seen the other two predictors of recession, although they are probably true by virtue of being correlated with one another.

These measures are good indicators because they proxy future consumer spending. They would be less reliable when predicting recessions caused by decreases in investment. Your thoughts?

Source:

Minding the Hinges on Pandora's Box

By John P. Hussman, Ph.D.

John Mauldin's Outside the Box, 1/7/2008

Posted by

Joshua Ulrich

at

7:55 AM

0

comments

![]()

Labels: Economy, Forecasting