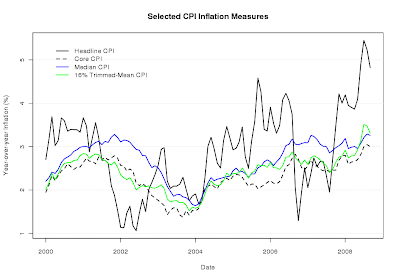

The chart below shows headline and core CPI have climbed sharply since mid-2006. Headline CPI is currently near 5% year-over-year, while all measures of core CPI are at 3%.

The following chart shows inflation expectations via the spread between the 10-year constant maturity Treasury rate and the corresponding TIPS rate. Expectations currently stand at an average of 1% per year for the next 10 years. I seriously doubt this will be realized; it's more likely a function of the current market pessimism.

Two important caveats: (1) the spread has two components - expected inflation and inflation risk premium, and (2) TIPS yields have a liquidity premium. Given the short-term nature of our comparison, neither of these caveats should be too problematic.

The Power of Diversification

21 hours ago

No comments:

Post a Comment