From this morning's press release:

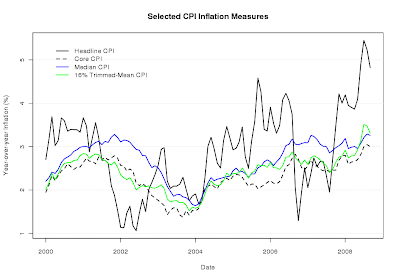

Inflationary pressures have started to moderate in a number of countries, partly reflecting a marked decline in energy and other commodity prices. Inflation expectations are diminishing and remain anchored to price stability. The recent intensification of the financial crisis has augmented the downside risks to growth and thus has diminished further the upside risks to price stability.

Some easing of global monetary conditions is therefore warranted. Accordingly, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, Sveriges Riksbank, and the Swiss National Bank are today announcing reductions in policy interest rates. The Bank of Japan expresses its strong support of these policy actions.

Federal Reserve Actions

The Federal Open Market Committee has decided to lower its target for the federal funds rate 50 basis points to 1-1/2 percent. The Committee took this action in light of evidence pointing to a weakening of economic activity and a reduction in inflationary pressures.

The futures market initially shot up in response to this news. Within an hour, however, they had fallen back to their pre-release levels. Perhaps the market realized this crisis has not been due to restrictive monetary policy, but rather deleveraging of financial institutions and ignorance of where those institutions' risk lies.

The spot markets gapped slightly lower but have been making gains since the open.